What is Shorting?

Shorting stocks is a popular trading technique. It has the potential to make huge profits but also includes a lot of risks of losing money.

Investors usually short stocks in anticipation of price decline. The motive behind this trading technique is to sell the stock today and buy it at a lower price in near future. If everything goes as planned, the investor will end up having the same amount of stocks but with a substantial profit in the pocket.

While shorting stocks, the investor does not own the stocks but has loaned these stocks from the broker. This strategy is not for beginner investors. Experienced investors with a record of trading success should consider a short-selling strategy like best covered call stocks.

Risks of Shorting

There is no denying the fact that with shorting, investors are exposing themselves to a huge amount of risk. Because this trading is executed on the base of pure speculation. With volatility so common on the stock market, not every time the stock goes as planned.

Therefore, the risks investors bear while shorting are:

- Timing is very important while shorting. There is a huge possibility that when the investor is interested in selling the share, there is no buyer for it in the market.

- While shorting the investors should remain active all the time. Because they have to act fast in case the price starts going up again

Shorting a stock is a challenging strategy and should be known and understood by all investors before practicing it. There are many highly overvalued companies that have trouble staying afloat. This gives investors opportunities for good stocks to short. Here we have compiled a list of the best stocks which can be shorted in 2022:

| Sr. | Company Name | Symbol | Market Cap | Share Price |

| 1 | Palantir | PLTR | $ 20.1 billion | $ 9.82 |

| 2 | SoFi | SOFI | $ 5.83 billion | $ 7.98 |

| 3 | Walgreens Boots Alliance | WBA | $ 33.82 billion | $ 39.13 |

| 4 | Paycom Software, Inc | PAYC | $ 22.3 billion | $ 371.49 |

| 5 | Marvell Technology, Inc. | MRVL | $ 43.6 billion | $ 51.26 |

| 6 | The Walt Disney | UTHR | $ 197 billion | $ 108 |

| 7 | Matterport | MTTR | $ 1.34 billion | $ 4.74 |

| 8 | Harmony Biosciences Holdings, Inc. | HRMY | $ 3 billion | $ 50.77 |

| 9 | Aspen Technology, Inc. | AZPN | $ 12.7 billion | $ 200 |

| 10 | Ford | F | $ 62.2 billion | 15.04 |

-

Palantir Technologies

Palantir is a software company. They build digital infrastructure for data-driven operations and decision-making. Its products serve as the connective tissue between an organization’s data, its analytics capabilities, and operational execution. Palantir’s software platforms allow organizations to better manage the data that they already lawfully control.

Palantir is a stock that has good prospects for medium-term and long-term investment. Palantir has several long-term contracts with government agencies, which will guarantee positive cash flow for several years to come. A few of them are:

- Palantir secured an extension with the US Army’s Program Executive Office for Enterprise Information Systems for its Army Vantage program in a deal worth $113.8m.

- Palantir has a running $89.9m contract with the National Nuclear Security Administration.

- The US FDA’s Center for Drug Evaluation and Research also awarded Palantir a $44.4m contract to enhance drug reviews and inspections.

- There is also an existing $111m contract Palantir has with the US Special Operations Command (USSOCOM).

- In 2021, Palantir announced that Japanese insurer SOMPO Holdings would invest $500m into its business.

- A $32.5m contract with the US Air Force and US Space Force.

Palantir Technologies Inc recently announced financial results for the second quarter ended June 30, 2022:

- Revenue was reported to be $ 473 million, a 26 % year-over-year increase

- Loss from operations was reported at $ (42) million

- Net loss was reported to be $ (179) million

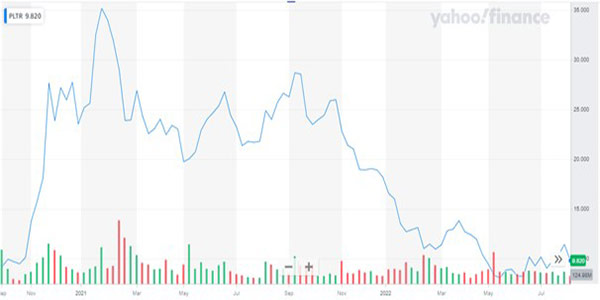

Palantir Technologies has a market capitalization of around $ 20.1 billion. Its share last closed at a price of $ 9.82. Looking at the past 2-year performance of Palantir’s stock, the stock is nowhere close to its peak price of $ 35.1, in Jan’21.

For the major part of 2021, the stock remained stagnant, maintaining a price level of above $ 20. But the stock changed course at the end of 2021. The year-to-date performance of Palantir’s stock shows a 22.7 % decline during 2021.

In 2022, the stock started off at a price of $ 18.2. To date, the stock has declined by almost 45 %.

-

SoFi

SoFi is a fintech platform that offers loans, investment accounts, and banking options. It has over 4 million members and has given over $ 50 billion in funded loans.

Founded in 2011, SoFi operates through three segments:

- Lending

- Technology Platform

- Financial Services.

The company’s lending and financial services and products allow its members to borrow, save, spend, invest and protect their money. It offers student loans; personal loans for debt consolidation and home improvement projects; and home loans. The company also provides cash management, investment, and technology services. In addition, it operates Galileo, a technology platform that offers services to financial and non-financial institutions; and Apex, a technology-enabled platform that provides investment custody and clearing brokerage services, as well as Technisys, a cloud-based digital multi-product core banking platform.

SoFi recently reported its second quarter review for 2022:

- Revenue was reported at $ 356 million, a 50 % year-on-year growth

- Net Revenue was reported at $ 1,235 million,

- New members of this platform were reported at 4,319, a 69 % increase year-on-year

SoFi has a market capitalization of $ 5.83 billion. Its share is trading at a price of $ 7.98. In the last two years, the share has been on a bearish run.

In 2021, the stock picked up a bearish path while exhibiting volatile behavior. During the year, the stock peaked thrice. First at $ 25.1 in Jan’2021, then at $ 23 during June’21, and lastly a $ 22.7 during Nov’21. Overall, the stock went from $ 18.74 to $15.81 during the year, representing a 16 % decline.

In 2022, SoFi stock started off at $ 13.74 and last closed off at $ 7.98. This represents a 42 % decline year-to-date.

-

Walgreens Boots Alliance

Walgreens Boots Alliance is the largest retail pharmacy, health, and daily living destination across the U.S. and Europe, with a presence in over 25 countries.

The company operates through the following segments:

- Retail Pharmacy USA – This segment engages in pharmacy-led health and beauty retail businesses and sells its products under the brand names Walgreens and Duane Reade

- Retail Pharmacy International – This International segment offers retail stores, which sell products of brands No7, Boots Pharmaceuticals, Botanics, Liz Earle, and Soap & Glory

- Pharmaceutical Wholesale. – This segment supplies medicines, other healthcare products, and related services to pharmacies, doctors, health centers, and hospitals

Walgreen Boots Alliance recently shared its second quarterly earnings report for the year 2022:

- Sales were reported at $ 33.8 billion, a 3 % increase on a year-on-year basis

- Income from operation was reported at $ 1.2 billion

- Net earnings from continuing operations were reported at $ 883 million

Walgreens boots Alliance has a market capitalization of around $ 34 billion. Its share is currently trading at $ 39.13. The past two years have been quite volatile for Walgreen’s share in the stock market.

The stock started off in the year 2021 at a price of $ 39.13. During the year it hit the peak of $ 55.3 and $ 54.3 and closed off the year at $ 52.16. Overall, the stock appreciated by 33.3 %.

In 2022, the stock started off at $ 52.16 and last closed at $ 39.13. Overall, the stock declined by 25 %.

-

Paycom Software Inc

Paycom Software Inc is a leader in payroll and HR technology. This Oklahoma City-based company redefines the human capital management industry by allowing companies to effectively navigate a rapidly changing business environment. Its cloud-based software solution is based on a core system of record maintained in a single database for all human capital management functions, providing the functionality that businesses need to manage the complete employment lifecycle, from recruitment to retirement. Paycom has the ability to serve businesses of all sizes and in every industry. As one of the leading human capital management providers, Paycom serves clients in all 50 states from offices across the country.

Paycom Software Inc recently shares its second quarter results ending 30th June 2022:

- Revenues were reported to be $ 317 million, an increase of 31 % from the previous year’s same period

- Net Income was reported at $ 57 million

- Earnings per share were reported at $ 0.99 per share

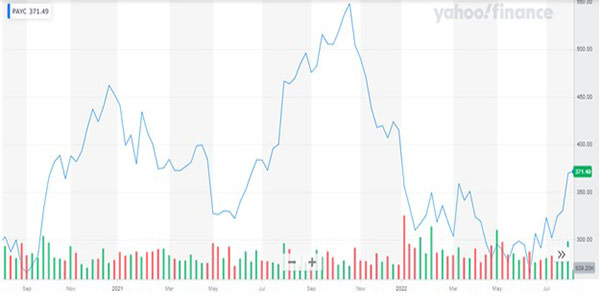

Paycom Software has a market capitalization of $ 22.3 billion. The share of the company is currently trading at $ 371.49.

The stock started off in the year 2021 at $ 452.25. After an initial decline, the stock started rising and peaked at $ 547.85. The stock closed off the year at $ 371.49, representing an 18 % decline during the year.

In 2022, despite being volatile, the stock did not rise much. Starting from $ 355.8 the stock last closed at $ 371.49, representing a 4.5 % appreciation year-to-date.

-

Marvell Technology Inc.

Marvell Technology Group Ltd. engages in the design, development, and sale of integrated circuits. The company offers System-on-a-Chip devices, which leverage a technology portfolio of intellectual property in the areas of analog, mixed-signal, digital signal processing, and embedded and standalone integrated circuits. It also develops integrated hardware platforms along with software that incorporates digital computing technologies designed and configured to provide an optimized computing solution.

Marvell Technology, Inc. is a leader in infrastructure semiconductor solutions. It recently reported financial results for the second quarter of the fiscal year 2022:

- Net Revenue was reported at $ 1.076 billion, a 48 % increase year-on-year

- Gross Profit was reported to be $ 372 million

- Net Loss was reported at $ (276) million

- Net loss per share was reported at $ (0.34)

Marvell Technology has a market capitalization of over $ 43.6 billion. Its share is trading at a price of $ 51.26. Since the last quarter of 2020, the stock of Marvell Technology picked up a bullish trend and continued throughout 2021. The stock peaked at $ 89.02 in Dec 2021, after which it reversed its course and started declining. Overall, in 2021, the stock appreciated by 84 % during the year.

In 2022, the stock started off at $ 87.49 and dropped to the lows of $ 42.55. It is currently trading at $ 51.26. Overall, the stock declined by 70 % to date.

-

The Walt Disney

The Walt Disney Company operates as an entertainment company worldwide. It operates through two segments:

- Disney Media and Entertainment Distribution

- Disney Parks, Experiences, and Products

The company engages in the film and episodic television content production and distribution activities, as well as operates television broadcast networks under the ABC, Disney, ESPN, Freeform, FX, Fox, National Geographic, and Star brands; and studios that produce motion pictures under the Walt Disney Pictures, Twentieth Century Studios, Marvel, Lucasfilm, Pixar, and Searchlight Pictures banners.

The Walt Disney Company reported earnings for its second fiscal quarter ended April 2022:

- Revenue was reported to be $ 19.3 billion, a 23 % increase from last year’s same period

- Net Income was reported at $ 470 million

- Earnings per share were reported at $ 0.26

The Walt Disney has a market cap of $ 197 billion. Its share is currently trading around $ 108. The stock of the company maintained its price level for the major part of 2021. It started off the year at $ 181.18 and closed off at $ 154.89. The stock peaked at $ 197.16 in March 2021. Overall, the stock depreciated by 14 %.

In 2022, the stock went from $ 154 to the lows of $ 94.34 and recently closed off at $ 109.49. Overall, the stock depreciated by 39 % year-to-date.

-

Matterport

Matterport is the standard for 3D space capture. Its all-in-one platform transforms real-life spaces into immersive digital twin models. Matterport empowers people to capture and connect rooms to create truly interactive 3D models of spaces.

22 % of the Fortune 1000 companies are Matterport’s clients.

Matterport, Inc. is the leading spatial data company driving the digital transformation of the built world. It announced financial results for the quarter ended March 31, 2022.

- Total revenue was reported at $ 28.5 million

- Net Loss was reported at $ (28) million

- Total subscribers grew by 70 % on a year-over-year basis

- Subscription revenue increased by 24 % on a year-over-year basis

- Total real estate market value expanded to $327 trillion

Matterport Inc has a market cap of $ 1.34 billion. Its share is currently trading at $ 4.74. The company went public in Feb 2021. After an initial hike in price, peaking at $ 24.46, the stock experienced a huge drop. Afterward, the stock started rising slowly and steadily. It again peaked at $ 27.89 in November 2021. Overall, the yearly performance shows an appreciation of 94 % during the year.

In 2022, the stock was bearish and went as low as $ 3.6. Overall, the stock depreciated by a whopping 75 % to date.

-

Harmony Biosciences Holdings Inc.

Harmony Biosciences Holdings, Inc. is a commercial-stage pharmaceutical company that focuses on developing and commercializing therapies for patients living with rare neurological disorders.

Harmony Biosciences is evolving and growing. The recent updates about the company are:

- In August Harmony and Bioprojet announced the signing of a new agreement focused on developing innovative therapeutics based on ProLiant, expanding Harmony’s opportunity in narcolepsy, and potentially other indications mutually agreed to by the parties.

- Phase 3 registrational trial in adult patients with IH (INTUNE Study) is off to a good start

- Completed enrollment in the PWS Phase 2 proof-of-concept study. On track for top-line data from this trial in the fourth quarter of 2022.

Harmony Biosciences Holdings Inc. recently reported financial results and business updates for the quarter ended June 30, 2022:

- Net product revenues were reported at $ 107 million, as compared to $73.8 million for the same period in 2021.

- Net income was reported to be $23.5 million

- Earnings per share were $ 0.39

Harmony Biosciences has a market capitalization of $ 3 billion. Its share is trading at a price of $ 50.77. During the past two years, the stock has been very volatile. In 2021, the stock went as low as $ 26.16 and as high as $ 43.9. Overall, the stock appreciated by 18 % during the year.

In 2022, the stock started off at $ 42.64 and last closed at $ 51, representing a 19.6 % decline year-to-date.

-

Aspen Technology Inc.

Aspen Technology, Inc. engages in the provision of asset optimization solutions. It develops its applications to design, and optimize processes across the engineering, manufacturing and supply chain, and asset performance management areas. The firm has two segments in operation, that are:

- Subscription and Software – This segment offers to license of asset optimization software solutions and associated support services

- Services segments – This segment includes professional services and training

Aspen Technology recently reported fourth-quarter results for 2022:

- Total revenue was reported at $ 239 million

- Net income from operations was reported at $ 39.2 million, as compared to a loss from operations of $ 8.8 million in the fourth quarter of fiscal 2021.

- Net income was reported at $ 57.2 million

- Earnings per share of $ 1.13, compared to a net loss per share of $ 0.23 in the same period last fiscal year.

Aspen Technologies has a market capitalization of $ 12.7 billion. Its share is trading at a price of $ 200. The stock of Aspen has been on a bullish run in the past two years. In 2021, the stock started off at $ 130.25 and closed off at $ 152.2, representing a 17 % appreciation during the year.

In 2022, the stock has appreciated by 33 % year-to-date.

-

Ford

Ford Motor Co. engages in the manufacture, distribution, and sale of automobiles. It operates through the following three segments:

Automotive – This segment engages in developing, manufacturing, marketing, and servicing Ford cars, Lincoln vehicles

Mobility – This segment includes Ford Smart Mobility LLC and autonomous vehicles business

Ford Credit – This segment comprises the Ford Credit business on a consolidated basis, which is primarily vehicle-related financing and leasing activities.

Ford shared its financial results for the second quarter of 2022:

- Revenue was reported at $ 26.8 billion

- Net Income was reported at $ 0.6 billion

- Earnings per share were reported at $ 0.14

Ford has a market capitalization of $ 62.2 billion. The share of the company is currently trading at a price of $ 15.04. The share picked up a bullish streak in late 2020. This continued for the whole of 2021. The stock of Ford went from $ 8.79 to $ 20.77 in 2021, representing a 133 % appreciation.

In 2022, the stock started at $ 20.77, peaked at $ 25.19, and then started declining. The declined till it reached the low of $ 11.32. The last closing of Ford stock was at $ 15.48.

Conclusion

Shorting a stock has its own set of rules, which are different from regular stock investing. It is a lucrative way to profit if a stock drops in value. But it should be kept in mind that it comes with big risk and should be attempted only by experienced investors. And even if you are an experienced investor, then, it should be used cautiously and only after a careful assessment of the risks involved.

Follow – https://financialapple.com for More Updates